The short answer is YES. You can definitely sell your business on your own. But, we chose this question as the topic because most business brokers will try to convince you otherwise. We have operated and sold businesses on our own. As such, we can say from first hand experience that the answer is “yes”. We even wrote a step by step guide that you can use to sell your business on your own – how to sell your business.

Actually, the question you should answer is “Should I sell my business on my own?” And, if you have an iota of doubt on the answer, we highly recommend giving this article a read. This article will answer another important and related question – “Who needs to help you sell your business?” These decisions will make a big difference in the end result.

This article assumes you are looking to get high premiums from the sale of your company. If you are looking for a quick exit and/or liquidation, some of these could be omitted. In that case we urge you to read our article on “How to sell your business fast”

We wanted to create an exhaustive resource that can help all business owners answer this very important and confusing question. As such this article is long. So, for a quick reference we have added this table of contents to help you guide through the article or if you just want to see the points.

To start with, you must understand the different things you need to do sell your business. You must read our flagship resource that will provide you with everything you need to know to sell your business. We have discussed all the roles in detail in that article. As such we will not get into details here. The different roles are marketing, financial, legal and advisory. You may also consider project management as a role, because selling your business is a project. However, this project needs to be executed differently and very discretely as compared to all other projects your company has undertaken.

You can bring key employees from your company into the sale process and create your team. However, they have to be trusted implicitly. Any breach of confidentiality can create unrepairable damages. If you have trusted employees that can partner with you for 6-9 months and wear these hats really well, then you have a winning team. However, such resources need to have a lot of experience buying and selling businesses. And, these are all critical roles for the day-to-day operations of the business as well. As such, it will be difficult for them to multi-task. Selling your business is not just an additional project. It is a completely different line of work as compared to your regular operations. So if you decide to delegate these roles to your existing employees consider the pros and cons that we mention here.

You and your partners can research, educate your selves and consult with advisors and contractors for a period of time and then try to sell the business. This can be a very rewarding experience. But most small to medium sized businesses need their partners to focus on growth and/or operations. This is even more important in the last year of your business when prospective buyers and their banks will inspect your business and its future possibilities. Unless you are completely hands-off from your business, you cannot take time out from your business to try and sell it. The most important point here is that selling a business requires a lot of experience and it is not a trial and error process. Mistakes are costly and can erode large portions of your valuation.

Eventually if you do decide to take the time to go by yourself and bring on a few of your trusted employees into the team, there are some things you will not be able to do.

Yes you can go through the whole process without an attorney, but most experienced buyers will not go through the process unless you get an attorney. Attorneys protect both sides. But more importantly, attorneys protect the agreement and the future of the business. Remember, closing the sale is a milestone but not the end of the process. You have to transition the operations and ensure that you abide by the purchase agreements. Attorneys on both sides will ensure fair trade and agreements as allowed by law. Most small to medium scale business buyers will use business acquisition loans. Such lenders will also mandate that both parties engage proper legal counsel.

Some lenders will mandate the buyer to audit your financials. Small businesses seldom have audited books and records. This is not something out of the ordinary because keeping audited books and records is time consuming and expensive. Most business owners will ensure they file the correct taxes. However, deductions, expense management, mingling of personal and business funds and accounts are not uncommon. These complications can force you to get an independent financial audit or you may risk losing a very good buyer and deal. You should also negotiate with your buyer and their lender to share audit fees or settle for less involved reports like quality of earnings or a financial review.

Many business sales involve purchase of fixed assets. These may be completely depreciated, beyond their useful life or currently on the fixed asset schedule. They may also be assets that are producing income for the business. For example, real estate that is rented or trucks and tools that are rented. If these assets are part of the business sale, your buyer and their bank may require you to provide an independent valuation report of these assets.

There are several things to take into account when you have decided to sell your business on your own and/or with an internal team. There may be several other nuances, but from our five decades of combined experience in buying and selling companies, we feel these are the most common.

We have written a very detailed article and have a lot of resources on our site to help you understand how to sell a business. We are also working on several free templates that you can use. Please stay tuned by signing up for our blogs and newsletters.

A lot of sellers wait for the buyer to tell them what type of exit they prefer based on the purchase agreement. The type of exit will have implications on taxes that you will pay, the transition, any debt, and assets. Make sure you read about the different type of exits. You can find a lot of different resources on our website as well. The two most common are equity sale and asset purchase. In general buyers prefer asset purchase while sellers prefer a stock sale from a taxation purpose, but remember that each deal is unique and there are no hard and fast rules. Asset purchases are more common, however bigger companies have more stock sale.

A lot of business owners leave the tax planning towards the end. They factor in a certain percent and based on that they set the sale price. In the end the numbers can be drastically different. Small changes at the outset can help save a lot of money. Taxation gets more complicated for multi-entity businesses, companies that have a lot of assets like equipment, real estate, inventory etc. You can also negotiate with a buyer better if you understand all the different types of exits and their tax implications. We strongly advice you to reach out to accountants and tax consultants that work in the business brokerage industry. You can always reach out to us and we are happy to extend our network to you.

Whether you hire a brokerage or consultants or go about the project on your own with key employees, you must create non-business emails and file repositories (data rooms). You need to start separating yourself and your personal information from your business, because soon your business with no longer be yours. Unless you are staging an employee buy-out. It is generally a good idea not to use your business email for personal use, but more often than not, business owners end up using one email address. Also, you need to be extra precautious from a confidentiality purpose because pre-emptive news of an impending sale creates unrepairable damages. Additionally, when you first reach out to potential buyers you should not divulge your company information so you cannot use your business email address.

It is not uncommon for your competitors to pose as buyers, especially in crowded and competitive industries. So setup stringent screening criteria before you hand out your CIM or memo. Ask for LinkedIn profiles, social profiles and resumes. Also ask them where they will have source of funds and the reasons why they are interested in your business based on the teaser they saw from your marketing efforts. You can ask them for proof of funds, but that is typically requested prior to signing a Letter of Intent (LOI). Serious buyers will have no issue giving this information to you. In fact, they want to give you this information so you can make better decisions and not waste their time and resources.

Ensure you have a bullet-proof NDA. After you have vetted a prospective buyer do not share any information unless he/she signs the NDA. We always mention explicitly that they should not share any confidential information, nor contact anyone linked with the company. We also tell buyers explicitly that they cannot use any information that breaches the non-compete clauses in the NDA. Telling them explicitly in addition to the NDA always has a better impact. They need to know that you are serious about confidentiality. If you do not have a good NDA you can always download one from our website. The best option is to get it made by your legal counsel of from reputed legal sources on the internet. Rocketlawyer and Legalzoom are good sources.

Buyers will almost always have a broker or investment banker or consultant that will broker the purchase. When they realize you do not have similar representation and additionally, you do not have experience buying and selling businesses, they will throw a lot of jargon, laws and rules your way. This is a big reason why business owners shield themselves from such intricacies and busy work by hiring a firm or consultant to represent them. However, if you are trying to sell your business on your own, you do not have to agree to anything until you have signed on a document that is binding. So stand your ground and it is not important to get back right away. Do your research and then answer, refute, disagree and negotiate.

Do not skimp on legal fees. A business purchase agreement is a legally binding document. You and your company will be legally liable for any misrepresentation, even if was unintentional. Sometimes a letter of intent can also be a binding document. Also you have to know everything that a buyer’s broker and attorney might slip into any contract or document. It is much wiser to go by the “trust but verify” approach. As such, you must hire an experience mergers and acquisitions attorney. We have a lot of free resources on how to hire the right attorney on our website or you can always call us to discuss for no obligation.

The last year of your business will most likely be the most important year. Prospective acquirers, lenders, auditors, accountants and lawyers will be inspecting your operations and future prospects. It needs to project a well-run business with great outlook. You and you core team will most likely have to pull long hours to work through this project and ensuring your business is running well as well as growing. It is important to create a well-buttoned project management plan as well as we have detailed in our flagship article.

You can always call us or comment here or email us to discuss anything. Unlike traditional brokerage or consulting firms, we focus on learning and sharing to better the buying and selling services and products of small to medium sized business. And, if there is a good fit for us to work together we then take the next step. Any and all conversations are a learning experience for us. So do reach out to us anytime for any question on the selling or buying process of a business.

In case you do decide to get help, we have explained how this industry works so you can make informed decisions. The brokerage industry, for buying and selling small to medium scale businesses, is fragmented and there are several types of services. There are about 3,500 business brokers in the United States and 10K to 15K advisors and consultants (Ref: IBISWorld). Big names like Sunbelt, Transworld and Murphy may work for you and they are great at what they do. But much like any industry, the big guns may not be something that you are looking for. Boutique brokerages can provide you with equal and many times a lot better services because they do not care about volume but on quality services. If you are a small business owner you will completely understand this. The following are the different types of services available.

A large number of brokers will sign you up with a monthly retainer and some commission on closing the sale. You may or may not be assigned a specific person. But most likely you will have a designated project manager. The amount of the retainer can vary and depending on your company and the brokerage the amount can be in the tens of thousands per month. You can expect the additional commissions to be as low as 5% and as high as 10%.

There are brokers and advisory firms that will charge a set amount to execute the sale of the business. They might have a cost plus model, where they will take a certain amount of money as milestone payments and an amount provided the sale is successful.

A very few firms and brokers operate on a commission-only structure. They get paid only if the business sale completes. Finding a good commission-only firm is difficult because the business sale process is extremely involved and takes about 9 months to complete, . Basically you are expecting someone to partner with you to sell your business. In the end the firm can walk away with months of hard work and not get paid anything if the business sale does not mature.

Typically the commission ranges are from as low as 7% to as high as 12%. While this may sound good, such firms may not be as engaged as firms that take a high retainer. But a good aggressive commission only firm can be an excellent choice. They share in the risk pool with you. They do all the work for no cost and only gets paid if you get paid. Most firms that are good in this structure are boutique and work with a handful of clients at a time because of the high level of involvement in each sale. They also pick their clients after screening them and only if they are best fit for each other because of all the risk they take.

There are independent merges and acquisitions advisors & consultants that can be hired for the process. Advisors & consultants typically have bought and sold businesses of their own and/or they work as independent brokers for several brokerage firms. Almost all advisors & consultants will work on a retainer for a set hourly rate and number of hours. Expect high hourly rates as this is a very niche industry and requires a lot of experience, knowledge and intelligence to structure and close deals. If you are hiring an advisor or a consultant, definitely vet them, verify their references. Also ensure you have a well-buttoned NDA and non-compete with them. You might be able to structure different deals with them – like some cash upfront, some on close. Additionally you can also hire a consultant for part of the process.

Project Managers are like consultants, but they would generally manage the whole project from start to end, keeping the scope, cost, time and expectations on part with the plan. You can have an internal PM, but most likely you will not be able to disclose the process or have free resources. You can take up this role, but like most small to medium scale businesses, you will most likely not have the time, especially in the last year of the business where you have to ensure that the growth is strong and operations are stellar. Also, this is a project that HAS to be managed well as it has a lot of different parties, most not in your control and targets that will keep moving till you are able to close the deal.

Typically IBs are hired for bigger deals – mid-sized organizations. They either represent the seller or the buyer. Almost always they work on a retainer and some cash at the end of the deal. Similar to consultants and advisors, expect to pay a high hourly rate and retainer, especially if the industry is very niche. Their main role is to establish fair value for a business acquisition based on market conditions. They can also provide strategic insight to the transaction by structuring deals that work for all parties based on their experience and knowledge. Typically IBs work for larger investment banks. They can also be market-makers because they might help introduce new securities to markets by creating the right new issue – debt or equity – and find the buyers for such issues.

New self-serve platforms are coming into the small business M&A world. But they are only self-serve up to a point. Valuation of a company can only be done automatically up to a point. Rudimentary valuations can be done easily – we have a simple formula you can use right now – click here. But buyers will figure out their own math based on a lot of factors – comps in the market, market conditions, industry conditions, macro environment, expansion options, belief in the products and services – these are only a few parameters. Before you sign-up with any self-serve platform definitely inquire how the platform does the valuation of your business. Once again, if you are not sure please feel free to reach out us – we are happy to provide you a free valuation of your business.

Now that you know more about the industry, the players and the whole process you are in a good position to figure out what type of partner and team you would like to work with. If you ask our opinion, we always recommend a commission-only brokerage that you like after you spoke to them. Commission-only brokerage firms will go the extra mile because they will not get paid anything unless they close the sale and get you the premium that you signed up for with them. Basically they are in the risk pool with you. They partner with you to sell your business.

A good commission-only brokerage firm will not rush you to sell your business. If they feel your business should not be listed now because of the market conditions or your expectations they will let you know and continue to work with you to figure out the best time to sell your business. Because of all the upfront work they have to do to close the deal, they are careful to pick a best-fit client. That protects you and your business interest as well.

It is important you set the right expectations from the whole process and the project. See our process to understand the steps and the typical timeframes for each milestone. It is also important to set the expectations with your entire team that you will create to sell your business. Typically, a good broker will not be shy to tell you the nuances and problems you will likely expect during the project. They are not worried about losing a client because they are more concerned about the project not going as per your expectations.

Remember, a good brokerage firm, consultant or advisor will partner with you to sell your business. If not, they are not a good fit. There are many resources in this industry that have marred the profession, much like many other industries. Our hope is that we are able to bring transparency to the process and make good business happen.

The bottom line is that you can always sell your own business. Our site and videos will teach you everything you know on how to go about doing that. In fact we urge you to educate yourself as much as possible so this way you can feel in control, which is important, because after all you will be the biggest beneficiary from the sale of your business and so you will have the biggest risk. Having said this, the reality is that you should not go at it alone.

In our 5 decades of combined experience and having sold businesses on our own in the past, we can vouch for the fact that the result will be significantly better if you pick a winning team. If you are not sure just contact us and we are happy to discuss more. We are a boutique commission-only business brokerage and we only work with a few clients at a time. Our mission is to bring transparency into this industry so we look at every opportunity to talk to business owners, learn from their business and contribute to the body of knowledge.

The Confidential Information Memorandum or CIM will probably the most important document you will be putting together for your business. It will be the culminating document that will give you the fruits of all the hard work since inception. A CIM is also referred to as an Offering Memorandum or OM.

We have written this from the perspective of a small to mid sized business. Although, bigger M&A deals also have similar documents that are prepared by investment bankers for big dollars!

The confidential information memorandum is a document that will be sent to potential buyers of your business. Typically this is sent after they have screened your company by reading a “teaser” executive summary. Next they sign an NDA with you and / or your broker. Following that they will get your CIM. Most potential buyers will make decisions on buy or pass after reading the confidential information memorandum.

A confidential information memorandum is not a legal document and does not bind any party. It is a marketing document which will showcase your company to prospective buyers. Most brokers, bankers (if hired), sellers have a tendency to dress up their business more than needed. They do this to project a stronger company than it really is. We will explain why this is is a dangerous idea, contrary to what a lot of folks will say. A well drafted confidential information memorandum will get you premium strategic buyers. Such buyers will pay you the premiums over and above your standard multiples.

A typical CIM has 4 broad sections. They are key highlights, detailed narrative of your business, growth opportunities and financial performance. We will break these down below. Please note there could be additional sections, sub-sections and topics. These may be applicable for your industry only. For example, regulatory and compliance, real estate assets and depreciation, environmental considerations, political implications etc.

Most buyers will read the summary and jump straight into the financial details which are typically at the end of the Confidential Information Memorandum. So it is really important to have a strong value proposition of your business in the summary. Think about this: If I were to buy a similar company what would excite me in a 1-pager?

These are the sections in the summary. It should be about 1–2 pages.

This is the overview of the company. You will have an elevator pitch of your company. Next you will summarize your industry, operations, markets and positioning, key employees and projections. Here is an excellent source on how to write a good Executive summary https://articles.bplans.com/writing-an-executive-summary

This shows the historical revenue, EBITDA, EBIT (3–5 years), SDCF, cash flow summary, balance sheet summary (total assets, liabilities, equity). There seems to be a lot of confusion on EBITDA and SDCF (Seller’s Discretionary Cash Flows). So here are some excellent resources from Investopedia.

EBITDA – https://www.investopedia.com/terms/e/ebitda.asp

SDCF – https://www.investopedia.com/terms/d/discretionarycashflow.asp

Discuss when your business was founded, where it was registered, the type of company, and the ownership summary.

Finally you should discuss why buyers should pay a premium for your business. Here you can summarize the historical performance. Discuss key growth opportunities along with some basis.

Most buyers will get to this only after they have assessed the key highlights and financials. This is the section where you will get into the meat and potatoes of your business. These are the topics in this section.

Focus on highlighting the opportunities of your industry. The content should be geared towards providing a competitive landscape of your industry. Here, do not focus on specific markets your business operates in or plans to operate. This is because a prospective buyer may, and most likely, try to expand into different markets. The goal should be to showcase that there is healthy competition. Focus on more growth potential than competing industries. For example pizzeria as opposed to deli OR IT services as opposed to web development OR veterinary clinic as opposed to pet grooming. Leave room for diversification to showcase the growth potential). We would highly suggest you purchase industry statistics. Quote steady growth numbers and protection from macro movements if possible. Refer ti reports that discuss how to handle inherent as well as perceived risks.

This is where you will present your organization. Think about this — if an inspector / auditor were to come in blind and go through your business so that you can get a “certificate of excellence” how would you present your company? Start writing it out in plain English. Then you can organize the content around these topics —

The primary focus here is to showcase the operations of the business today and how it evolved since inception.

Think about you buying this business and growing it exponentially with unlimited capital, resources and nothing to worry about. If you were set free to grow your business today what would you do? Do not worry about what a potential buyer may think on why you have not done all these.

Discuss how it will be easy to expand to certain markets. Do a risk assessment of venturing into such markets. Provide opportunity numbers with references to reports, articles and statistics.

What additional marketing can benefit your company, what are the costs and returns? How should such marketing be done?

How should sales be improved to close more deals, increase the acquisition rate, reduce acquisition costs, have better transition of sales to operations, penetrate deeper into current customer base, segments, better organization and teams, better systems and processes.

Discuss how the business can create additional product lines and services by complementing a few things in your current operations, doing joint ventures and partnerships, leveraging certain suppliers and distribution channels, marketing and selling internal processes and systems.

This is extremely crucial. Spell out the skeletons but explain how they are very well accounted for and managed or how they can be easily mitigate or transferred (e.g. buy insurance, outsourced). The best thing to do is to do a proper risk assessment and present the highlights. Every buyer knows there are weaknesses in every business. If you are not sure how to do a proper risk assessment of your business please do reach out to us and we are happy to help you with the right resources or discuss your needs.

Strategic rationale on pursuing new opportunities, business model analysis with assumptions, case studies from other companies, industries, segments, identification of pilot opportunities, operational changes needed, approximation of costs and resources, suppliers and procurement details and finally, expected returns with payback periods.

This section needs to be well-presented from structure, simplicity, exhaustiveness and professional perspectives. If you are not 100% sure you can do this, it is better to get your accountant to prepare this. If you cannot discuss this with your accountant (due to confidentiality) you can hire consultants (make sure they sign an NDA). Typically these are the sections —

A lot of brokers, bankers, consultants and business owners have a tendency to over-dress their company so as to attract premium, strategic buyers and then working down from there on — basically trying hard to put lipstick on a pig. We are not saying your business is analogous to a pig by any means, but you get the drift. It is much better to project a conservative view of the business and focus on supporting that fact with numbers, results, reports, and industry statistics. This way you can work up from there. It is MUCH easier to work up on numbers than working down during interviews. Your confidence will get through to the buyers.

Selling anything, and especially selling your business, is a transference of feeling. If you are passionate, genuine and confident it will get across. The reverse is even more true.

…and remember…trying to put lipstick on a pig also annoys the pig!

A CIM is not a legal document and it should not contain any legal clause or statements that can give out a sense of binding a prospective buyer to anything at this early stage.

You will find a lot of articles that mention not to add a valuation section in the confidential information memorandum. If you are trying to sell a small business and approach a broker, the brokerage will advertise your business (confidentially) with a purchase price. Just search online and you will see the examples. So prospective buyers will know what you are expecting for your business. However, we would advice that the confidential information memorandum should not contain any details on how a valuation was reached. This will open up a lot of discussion early on which will simply waste a lot of time.

Serious and experienced buyers will ask questions about growth potentials, customers, management, operations, risks and opportunities instead of negotiating how you reached a certain valuation at the early stages of the sale. They will focus on that during due diligence. So, in the CIM you should not have anything regarding valuations, calculations, multiples or goodwill. Larger companies have no valuation at all — brokers, bankers present the CIM and get buyers to bid on the company.

You have spent a lot of physical, emotional, and financial capital building your business. A lot of blood, sweat, tears, and sacrifices went into the DNA of your company. It is your pride and joy. Why would you use a generic template that is not even industry specific to construct the most important document of your business?

The CIM is not about being an author or a write or a journalist — it is about putting your heart and soul, putting your pride, on a 50-page document that will win the heart and soul of a buyer who appreciates your efforts, your business, your industry, your markets, your employees, your suppliers and you.

It is extremely important to work with a team to develop your CIM, one that will make you really confident when you interview with prospective buyers. The process of documenting your business for sale is actually very rewarding and more importantly, during the process, you will think of many things that will help you to tweak, mitigate, plan and address your regular day to day operations as well.

…and in case you actually have 2 days to write a confidential information memorandum because of some urgency we have a template that you are free to use. We still urge you to reach out to us and we are happy to help. Remember, we are a commission-only brokerage firm so talking to us does not cost you anything. At best we might be able to work together to sell your business and at worse we will get to learn and discuss more about business, which is our biggest incentive every time we speak to a business owner.

A confidential information memorandum is the best document you will write for your business. It may seem daunting, but if you sit down and give yourself some time to think about all that you have done and could do for your company, you will see that it is not a difficult process at all. In fact it will be extremely rewarding personally. You can also find many articles online that writes about how to read a confidential information memorandum or how to evaluate a CIM from a buyer’s perspective. We would suggest you read these — it will give you an excellent idea on what buyers would do when they lay hands on your confidential information memorandum. A CIM is a first step towards selling your business, one that will make the all the difference in how the entire sale happens and even beyond through to transitions.

We are happy to discuss more and help — just reach out to us here. All the very best!

Selling your business is very easy. This is a very quick guide in “How Do I Sell My Business” You just need to make sure your financial records are in order, compile a valuation report, create a comprehensive memorandum. Get yourself a non-disclosure agreement for the buyers that inquire about your business, ensure that your employees do not know that the business is for sale. Advertise the business on over dozen plus sites including LinkedIn, Facebook, Twitter and Instagram. Also do not forget the print marketing either. Engage with the buyers on daily basis to provide them preliminary info about the business and perhaps detailed financials. Get on conference calls, follow up with every one of them at least once a week and you I’m sure you will sell your business.

This is a quick guide in “how do I sell my business”

So, there you have it, I laid it out all for you to do. It’s seems easy, right? But what if you were actively running your business at the same time. Would you have time and devotion to pursue buyers? Will you be successful in running your business while seeking a good match for your business?

Good question to ask, right? and this is why you need a full-time business broker who can do this for you. A great business broker can alleviate all this for you. He/she can free up your time so that you can focus on your business while the pursuit of sale is being handled by a professional. On average it takes about 6 – 9 months to sell a business. That is a long time and resource commitment for selling a business.

But if you want to pursue it yourself, visit https://gillagency.co for a more detailed plan to follow.

Contact us for a free confidential consultation.

There are team of advisors that you will need as you are in the process of selling a business. Just like how you run your company and have directs who report to you. You will need a team to wave you towards the closing table. A business broker should engage with all parties involved in selling a business. This is to make sure that everyone is moving in the right direction. In addition, that individual will market the business. If you don’t have a business broker, then that role will fall upon you as the seller. So let’s get right into who are all the parties involved in selling a business.

First and fore-most you will need an accountant who knows your business inside out. That individual will be critical in answering financial questions that the buyers may have. In addition to creating several reports for the due diligence, your accountant will facilitate the due diligence. Next would be a great attorney who specializes in business sale transaction. This is very important. You will need an attorney who understand the language of business contracts. Here is an excellent resource – https://www.lawyers.com/legal-info/business-law/buying-selling-businesses/the-process-of-buying-or-selling-a-small-business.html. The attorney can negotiate in keeping the best interest of you while coursing towards closing. In case there is an impasse between the attorneys. We always advise both sellers and buyers (and the business broker) to get on a conference call to resolve the issues. By this method we have saved a lot of deals and successfully brought them to the closing table.

The accountant and the attorney will also need to work hand in hand to draft up and finalize the contract. You, as a seller need to keep a close eye on both your attorney and the accountant. This is to ensure everyone is communicating and working efficiently towards the end goal – the closing. For more details head on over to https://gillagency.co/how-to-sell-my-business-a-step-by-step-guide#buildteam. You should read more information on who are all the parties involved in selling a business on our site.

Like many business sellers, who are looking for an exit strategy have the same question. What is the first thing I should do to sell my business. You can watch a short video on YouTube – https://youtu.be/3mtJafwyBOY

We at GillAgency have written a very extensive article on https://gillagency.co explaining in detail how to do just that. We think you will find this very useful.

Today I’ll briefly go over what is the first thing as a seller you should do to sell your business.

Firstly, you have to have your financials in order. When I was in the business of buying businesses, I was quite surprised when the business owners didn’t really know what their cash flow was. This is a turnoff for potential buyers and the due diligence can drag on for many months. When we represent a sale of the business the first thing we do is just that. We analyze the profit and loss statements, balance sheets, tax returns, and other financial statements, with the help of the seller and the accountant. During this process the seller realizes how important these line items are on the financial statements.

You as a seller need to sit with your accountant and go through these statements to figure out what your cash flow is, among other items. Knowing the cash flow will help you apply your industry multiplier to come up with an asking price. It also helps you be more educated when you are talking to buyers and they have questions regarding your financial statements. You can easily answer the buyer’s questions without having to go back and forth with your account.

As always we are here to help answer any questions that you may have and or to assist you. We are bettering the business brokerage world through ethics, honestly, transparency and education.

I had previously made a video highlighting how you can sell your business. Today I would like to piggyback on that video and provide a bit of an insight. ; Selling your business on your own & time.

You can watch a short video on youtube – https://youtu.be/xFLLmyDikyM

This week I had the pleasure to meet up with a seller of an Auto Tech business. The business was established over 20 years ago, making almost $1MM in cashflow.

We met at an outdoor dining facility and sat for about two hours, so that I can understand the business and his personal goals. I learned a lot from the meeting. I learned how he got started, the mechanics of the business, his motivation of selling the business. The strengths, the weaknesses, the opportunities and the threats to the business. This is what we call the SWOT analysis.

It’s very important for me to learn the business and what my client’s personal goals are. Why, because when buyers have questions I can answer them intelligently without bothering my client.

He was so passionate about his business. When I asked if he regretted anything in regards to his business, his response was that he wished that he started the business 10 years earlier as it has been very profitable for him. He told me that he has done his research and had thought about selling the business by himself, and he did just that. He listed his business for sale by himself.

But could not keep up with the sale process of the business, could not keep up with the inquiries, could not keep up with fielding the buyers, could not keep up with following up with the buyers, could not keep up with the buyer’s questions and request for financials, could not keep up with who has the money to buy his business from the tire kickers, all while running his business.At the end, he thanked me for my time and appreciated my eagerness to learn his business. This is what we do at GillAgency, we get to know you as a person as opposed to just a listing.

We have written an extensive article on what it takes to sell your business – https://gillagency.co/how-to-sell-my-business-a-step-by-step-guide. If you so decide to hire a business broker to handle this for you, please head on over to https://gillagency.co/our-process to learn how we can assist.

The basic steps required to sell any business is pretty much the same. We have written a very detailed step by step guide on what it entails to sell a business. You can read it here. We urge that you do spend some time reading that article first. Now, every industry has some nuance. It is important to factor in those nuances during the sale of a business. In this article we will discuss what manufacturing business owners will have to do additionally.

Manufacturing companies, especially in the small to medium sizes are seeing record mergers and acquisitions. There can be a few definitive reasons. Baby boomers are exiting businesses. Manufacturing is going through rapid disruption with the advent of automation, artificial intelligence and robotics. Private equity firms, search funds, and independent sponsors are seeking out manufacturing companies with good history and requiring transformation.

We have seen this from our experience, industry reports and also from requests by our large database of buyers. Typically the deal-size for the small to mid-market manufacturing industry can be split into a few buckets. These are -> under $1M, between $1M to $5M and greater than $5M. This classification is primarily based on the buyer profiles as well as the source of funds to make such acquisitions. The strategy, planning and execution of a deal in each of these tiers are slightly different. This is especially true over the last 10 years. Below you will find detailed steps on how to sell a manufacturing company. These steps are common to all the tiers we have mentioned. There will be nuances which we will cover in subsequent articles. You are always welcome to reach out to us anytime to discuss specific needs.

These are the most common steps to sell a manufacturing business with excellent results in the fastest possible timeline. The average time to sell a small to mid-sized manufacturing business is about 6 to 9 months. Motivated sellers have also managed to see exits in 12-16 weeks and we have made such deals happen in the past. If you are able to complete a lot of these steps prior to listing your manufacturing business for sale, the timeline can be significantly shorter and the price you will get will also be higher. We can vouch for this from our decades of experience buying and selling manufacturing companies in the small to mid-market sectors.

It is important to ascertain your company’s “fair” valuation. This need not be the listing price, although most of the times, it is the listing price. A fair valuation takes into account several things. These are (a) cash flow of your business, (b) expenses that you can add back to your bottom line (to reach a discretionary cash flow), (c) industry multiples, (d) comparables, (e) goodwill, (f) asset valuation to name a few. Without a proper valuation you will not have a benchmark to start with. You will find it difficult to defend you price to buyers, lenders, funders, consultants and brokers of buyers. Being extremely confident of your company’s valuation shows that you are an experienced seller. That will also fetch premium buyers that will pay higher multiples.

Manufacturing businesses will have both tangible and intangible assets in the books. Depreciation and Amortization schedules will have to be clean with proper explanations and assumptions. You can increase the valuation of your manufacturing business by taking these as add-backs. However, without a proper schedule and basis, you will find yourself painted into a corner during negotiations. If you are not sure how to do a fair valuation please feel free to reach out to us. For all our clients we offer no-obligations free valuations.

Most business owners leave tax planning to the end. They get caught up in all the work that needs to get done during the sale process. We have seen many times that sellers have not done any tax planning. In the end, they end up shelling out a large portion cash after closing. Most small business owners do not have the time, nor the interest in doing their own taxes. They hand it over to their accountant or “tax guy”. As such their knowledge of business taxation is not clear. This is by no means a ding on business owners. Most business owners do not need to know the ins and outs of taxation. But it is extremely important to know the different tax implications on the sale of a business. This is true especially if you are trying to sell your manufacturing business on your own.

Manufacturing companies typically use different depreciation models and schedules as opposed to say a technology company. Assets are valued differently. So if you are signing up for an Asset sale as opposed to a stock sale you will have different tax implications. We always recommend that you hire tax consultants and attorneys that understand these nuances. If you are not sure you can always reach out to us. We are happy to refer you to our network of tax consultants and attorneys.

Exit planning is a key step to selling any business. It is even more important when you are trying to sell a manufacturing company. Manufacturing companies have a lot more moving parts. But most business owners do not want to spend too much time time on planning. They live to execute tasks and hit deadlines. There are circumstances during a business sale where such speed is necessary. But for most of the sales, a few extra weeks of planning will make a big difference.

In fact good exit planning is critical to achieving good results from a business sale. Manufacturing companies have hard assets and a supply chain system that needs to be properly cleaned up, dressed and marketed. We have written a detailed article on how to do proper exit planning. We urge that you read this resource and also reach out to us to discuss specific issues or concerns.

At GillAgency we believe that business owners can sell their business on their own. However, we also believe that they should not go at it by themselves. You have to continue running your business. In fact, you need to keep generating excellent business results. Especially in a year when prospective buyers and lenders will be scrutinizing your business and its future. We always recommend building an exit team. You will definitely need legal and accounting. Additionally you should bring key personnel from your business into the team.

We always recommend that you hire consultants and advisors. GillAgency has vast experience in providing such advisory. Please feel free to reach out to us. You can also read our resource on how to build a winning team to help sell your business. Manufacturing businesses have more roles and responsibilities than other types of businesses. MRP, Logistics, Warehouse, Compliance, Procurement, Inventory management – these are critical roles that will need representation during the business sale process. A well-written CIM and good data room creation can greatly reduce all the risks associated in this step.

Most manufacturing businesses will have some sort of compliance and standards. For example, toxic waste disposal, environmental guidelines for manufacturing, material procurement standards, supplier verification processes, machine operation safety regulations, incident management standards, workman’s comp and other legal and compliance should be up to date. If there are gaps which are difficult to fix in the short term, you should highlight them. Do not hide them as they will pop-up later and cause more problems. Provide proper explanations on why they cannot be fixed right away. Explain risks they will pose and cost implications to a new owner. If you have certifications you should definitely highlight them.

We understand that there is a cost to being 100% compliant. Small business owners may not even know about all regulations. However, it is important to research and understand all regulatory laws in your industry. This is extremely important prior to listing your business for sale. GillAgency has a lot of knowledge across a vast array of industries in the manufacturing brokerage space. Our large network of consultants, buyers, academia and government contacts allow us to present a large body of knowledge to our clients. You are always welcome to reach out to us to discuss your business and industry.

The critical area where we see a lot of manufacturing companies struggle is standard operating procedures and policies. If you have a shop floor it is critical that you have basic policies and procedures mapped out, displayed and readily available. Every industry will have its specific set of policies and procedures. Some of these will be required by law. You must have these signed by all your employees and even vendors and partners that come under them.

It is beneficial to have an online resource to manage your SOPs. There are several systems and online software that allow you to manage your SOPs. If you have nothing setup, it is not difficult to get these completed. Start with searching them online. Do not blindly copy or plagiarize as it will come out easily during due diligence. You can use these sources to adapt to you business. You can then map out your internal processes in flow diagrams and save them in PDF formats. There are many software systems that allows you to create such process flows (microsoft visio, draw.io, lucidchart). If you are really strapped for time, you can draw them on paper and scan them into PDF documents. Remember to save all your SOPs in an online repository (SharePoint, OneDrive, DropBox, Google Drive).

You must clean up your inventory – physical inventory as well as all records. Ensure you have your counts matching your books. If you have made inventory adjustments that are material to the financials you must have proper explanations. A lot of companies will take inventory adjustments to inflate their gross profits. It will be caught very easily in due diligence.

Remember, in a business sale there are several eyes on your business and you books – the buyer, their broker, their accountant, the lender, the lender’s underwriter, SBA consultants. It is near impossible to have something slip by all these parties. One red-flag will not only delay the sale, it will result in buyers walking away. Most buyers will use it as a negotiating point. We have seen so many times, a seller making out-of-the-ordinary inventory adjustments mid-year. They claim that they had to do it to get the business ready for sale. It never works. This is one of the reasons why you ideally plan to sell your business at least a year before you do so.

If your industry and business relies on your location, then make sure you have presented the pros and cons. You much present that properly in your offering memorandum. For example, there can be a competitive advantage to being close to a reputed supplier. But if your supply lead times are long, then you should explain how you manage demand forecasting. Or, if your primary customer base is not close then you should discuss strategic shipping relationships. That may allow you to keep a remote cheaper location, and service a diverse customer base.

The important point here is that you should discuss about your company’s geographic location. Most buyers would like to understand how easy or important it is to relocate the business. If it is not possible or it will greatly impact the performance of the business, it is better to highlight that so that only local buyers are interested in your business. It is no point wasting a lot of time with buyers only to find out that they will not be interested in your company because it cannot be relocated.

If you have a warehouse then it is important to ensure that your warehousing processes are well documented, clean and managed. At a minimum, ensure your receiving, put-away processes, picking, packing and shipping processes are properly managed and documented. For receiving it is good to have a proper inventory management system, labor management system and other ancillary processes like dock schedulers and pallet management. In your put-away processes, you should demonstrate how you have optimized the movement of suppliers to optimized locations. Use of slotting, storage management and space management techniques should be highlighted. For storage it is best to ensure that you have the proper key performance indicators (KPIs) set, measured and analyzed. For picking you should have a good item maintenance and classification and in packing your items should have proper dimensions, weights and measurements.

Lastly for shipping, you must detail out the process, all 2PLs, 3PLs and any company that you are using and how they are integrated with your business and your systems. We understand that small businesses may not have the luxury of implementing expensive software, but before you start to sell your business, you should definitely document out your processes and try to clean up the warehousing processes as best as you can.

List out all your computer systems and ensure they have the necessary security updates and upgrades. If you have any legacy software, you should discuss the continuity of the system with your prospective buyers. We have seen systems written in the late 1970s which do not have any more support and the vendor is no longer in business. In such cases we advice our sellers to spend some time to map out the processes and flow chart out the operations. This can help a buyer send that to a software company to see what it would entail to upgrade the systems in case they do not want to use the legacy software anymore. Better still, you can do the same and provide estimates to buyers on what it would entail to upgrade your legacy software.

If you have up-to-date systems, then ensure you have detailed out integrations and process management. Keep a list of users, access rights, user accounts and any security audits that you have done. Ideally your accounting systems should be integrated with your manufacturing systems. If not you should document how you book your accounting journals from your manufacturing systems and processes. We tell our sellers to provide a list of systems that are used in the industry and explain how their business systems and implementations keep them lean and competitive.

You should have all your supplier contacts and contracts in place. It is important to keep a historical record of all suppliers, as far as back as you can trace them. This shows a good supplier management process. If you have a very important supplier relationship and that is a competitive advantage, you should definitely highlight that and explain why that is a competitive advantage. On the flip side, if you are very reliant on a sole supplier or a small number of suppliers you must explain how that is relationship is protected and can be transitioned to a new buyer.

Ideally it is best to have a healthy mix of suppliers across different regions – some drop ship, some contract and some sole suppliers. However, that is almost always not possible, especially for small business owners. As such we always advice our sellers to focus on the contracts and agreements, along with a historical record of the relationship. If you have supplier management reports like late shipments, pricing breaks, inventory lead times, backorders, buy-backs etc., you should highlight them.

You have to ensure that all your shipping and distribution records and processes are well documented. If you have a 2PL, 3PL or 4PL managed logistics then ensure that you have all contracts up-to-date with historical records. It is also important that you have detailed records on all vehicles, their book values, depreciation schedules and maintenance records. Companies that use Fulfillment by Amazon or other similar distribution companies, it is important that you explain how they can be a competitive edge to your industry as well as discuss the risks. A good buyer will always want to see the risks labeled out as well as explanations on how to manage the risks. Risks can be managed by either mitigating them or even transferring them (e.g. buying an insurance policy or outsourcing the risk).

If you have protected your company and investments through patents, copyrights or intellectual property (IP), then you should definitely highlight that. More importantly, the records should be up-to-date and readily available. If there are patents then you have to be careful on how they are transferred to a buyer and as such you have to work with your attorney on the legal frameworks for such transfer of patents and IPs. While a buyer will always ensure that such assets are transferred correctly, we have seen many cases where these have not been done correctly only to result in a lot of headache post-sale for both parties. If you have created patents that give you competitive edge you must properly valuate such assets.

There are several valuation methods that will definitely increase the value of your company. They will depend on the industry, the life of the patent, the coverage of the patent and several other factors that should be taken into factor. A good patent attorney (or your patent attorney) should be able to provide you better guidance. You can always reach out to us and we can help you with our valuation process and legal networks. You should also ensure all legal documentation of your business, starting from formation, articles, EIN, acquisitions and investments (if any) and all the way to customer, supplier and partnership contracts, are up-to-date and in place with historical records.

You should be prepared to have prospective buyers walk through your shop floor. We always say that tidy up your shop floor as if you are going to go through a quality audit (for example ISO). Definitely clean up anything hazardous or anything that can look dangerous. A clean and tidy shop floor signals a well-run operations. Ensure you have safety and regulations up on big signs and charts across the shop floor. Label everything and have your manufacturing team ready for inspection. It is best to rehearse the inspection – what you want to highlight more than others, what needs to be discussed further, why certain processes have to be done in a certain way and how the shop floor arrangement is a competitive edge as well as will help in scale and growth.

If your business owns real estate, you should spell out clearly if the real estate is part of the sale and the price or not. If it is part of the sale and not in the price you should definitely provide a market value. We have seen many offering memorandums where real estate is part of the sale but there is no market value provided. For a lot of buyers this is a big turn-off – we know because we have spoken to thousands of buyers during our decades of experience.

Provide a basis for the real estate valuation. We recommend you hire a neutral party to do the appraisals. You can always ask for more because of locational or historical advantages. If the real estate is not part of the transaction, you should explain how depreciations will impact the buyer’s books post-sale. We always try to be proactive in our approach because it saves a lot of time and headache during due-diligence.

We have written a detailed article on what you need to do to prepare for due diligence. It is so important to prepare for due diligence before you list your business up for sale. We have seen at least half of all business sales end up getting abandoned or not reaching their full potential because of issues found in due diligence. These could have been easily avoided with a little preparation, planning and fixing.

At a minimum for your manufacturing business, you should prepare for good buyers to visit your warehouse(s), shop floor(s), meet with your key supplier(s), talk to your key employee(s) and go through all your company’s documents and financials. We always tell our clients to be prepared for a full-fledged audit of their company. While that may sound scary, it is actually not that difficult if you sit down and plan for it. The alternative is not good because you will leave a lot of open ended issues which will greatly reduce your chances of finding a good buyer with a good deal. Remember an LOI is only a document that has intent. The real purchase agreement happens only after a successful due diligence.

Once your manufacturing business is ready for sale you will then work with your broker (if you have recruited one) or with your marketing team to market your company. Typically this entails first creating a CIM (confidential information memorandum). We have written a detailed article on how to create a CIM. You can also download a free CIM template from our resources.

Next, you will create a “teaser” which is basically a redacted executive summary of the business. We have a huge buyer database from decades of being in the business and if you work with us we will market your business to all our buyers. Additionally we will list your business in the top classifieds. These include BizBuySell.com, BizQuest.com, BusinessBroker.net, LoopNet.com, BusinessesForSale.com, BusinessMart.com and a few more. You are welcome to list your business teaser at these. However, we have seen that good buyers will typically work with brokers because they know that experienced brokers will make the buying process much smoother for all parties, saving everyone time and money.

Typically if the business has been marketed properly and there is a good active buyer database that you have access to, you should receive interest within the first week. Prospective buyers will reach out to inquire about the business after reading the teaser. Based on that they will sign an NDA and get the CIM. A good broker should be able to answer all buyer questions and satisfy the buyer. Most buyers will want to have a screening interview with you. The screening interview is your chance to pitch your company. You cannot over-sell your business because good buyers will do their due diligence in time. So do not feel shy to talk up your business and your achievements. Focus on the high points and touch up on the weaknesses. Remember to read your CIM before your interview because the buyer will have that in-front of them.

Based on the interview the prospective buyer will send you a letter of intent. We always try to get multiple letters of intent for our sellers. Buyers will try to force an exclusive LOI, which means that the business have to be taken off the market during the due diligence process. We always try to negotiate a non-exclusive LOI. This may not work with very good buyers who will try to negotiate a shorter due diligence in return for an exclusive LOI. The best case scenario is that you receive multiple LOIs with short due diligence periods (30 days is excellent, 60 days is normal).

Due diligence trips up a lot of business sale, especially manufacturing companies. There are a lot more moving parts to a manufacturing business than say an online business. Online businesses have a lot of intangible assets which poses other challenges. Manufacturing companies in the small business sector, on an average, go through a 60-90 day due diligence period, although we have seen 30 day due diligence as well. Of course this will depend on the size and complexity of the company, but we always advice our sellers to negotiate a due diligence period that is no more than 60 days. You might be able to negotiate a non-exclusive LOI if more due diligence is required. In that case your business can still be marketed to other buyers.

Remember, most buyers will come with a lender who will do their own due diligence of your records that they receive from your prospective buyer. Be ready for a financial audit if your books are not solid. You can read our detailed article on what happens during due diligence, what to watch out for and how to successfully complete a due diligence of your business. For a manufacturing company, it is important to list out additional items in the LOI in the due diligence section – how inventory, warehouse and manufacturing processes will be inspected and audited.

Congratulations on getting through due diligence! The next step is to hire your closing attorney. We always recommend you get an attorney that has done mergers and acquisitions for manufacturing businesses. There are nuances to the transfer of assets, liabilities, patents, goodwill that will have a lasting impact for both the buyer and the seller and unless you have an experienced attorney that has done a lot of these deals, you are at risk of legal exposure post-sale.

A purchase agreement can have a lot of pages and legal language – at a minimum you will have the terms of the purchase (most likely it will be an asset purchase as opposed to a stock buyout), indemnification clauses, non-competes and any transitional agreements like continued consulting for owners. For a typical small business transaction for a manufacturing company, expect to see 40-50 pages in a purchase agreement. Most purchase agreements will have the buyer escrow a “good faith” deposit (typically $25K to $50K depending on the size of the transaction).

A closing date is set once the purchase agreements are accepted by buyer, seller, buyer’s lenders, lawyers and brokers. Lenders will almost always control the closing date. It is important to keep working with your buyer and their closing team to motivate everyone to move towards a close. We have seen transactions sitting for 2 months even after the purchase agreement has been signed because the lender has not been able to schedule closing. Closing typically happens at the buyer’s attorney. However, a lot of closing happens remotely as well, especially if the different parties are present in different geographical regions.

At the close, funds are escrowed with the buyer’s attorney and asset exchange hands. You will see cash hitting your bank account once the signatures are completed. Expect to do wet signatures – so if you are not present, you will have to courier signed agreements. Congratulations – you just sold your business!

Post sale transition and integration is another area that trips a lot of sellers and buyers. It is extremely important to set the expectations for transition before purchase agreements are drawn. During the sale process both buyers and sellers go through a courtship and things are almost always rosier than they will be during the transition period. Skeletons will come out, personalities will clash and ownership will hard to let go. It is therefore important to “play out” the transition before the close. We actually sit and rehearse a possible transition course – what happens on day 1, week 1, month 1 and so on. This will almost always change a few things in the purchase agreement. In cases where there are earn-out clauses or even seller financing, it is absolutely critical that you put all the transitional clauses in the purchase agreement.

Remember to have termination clauses that are agreeable by both parties. There are a lot of elements to a good and successful transition. Selling a business does not end at the closing table, it really ends once a buyer has successfully taken over the operations – sometimes that can take a year or longer depending on the size and complexity of the business.

Selling any business can be a daunting task. This is true especially if you are looking to get top dollars for your company. Finding the right buyer that can continue on with your legacy should also be a consideration. Selling a business is not a complicated process at all. We have a lot of resources that have helped many business owners break down the steps. There are many brokerage firms and consultants who try to create a sense of doom with smoke-n-mirrors. At GillAgency our goal is to bring 100% transparency to the business sale process. We want to give business owners all the information before they decide how they want to sell their business.

We firmly believe that you can sell your own business. The only caveat is that you must have 6-9 months of full-time effort of you and your exit team. Most business owners do not have that luxury. That is where boutique commission-only firms like us come to your service. We have sold several manufacturing companies across different industries. So we know the challenges and nuances which we can defend with buyers as well as their lenders. We also help our sellers stage and clean up their business before they list their manufacturing companies up for sale. That is the only way to attract the premium buyers and get the best value for the business. One red flag leads to a domino effect of questions, inspections, doubt and fear. That leads to a lot of wasted time and money.

As such we highly recommend that you speak to us before you start selling your manufacturing process. Please access all our resources to educate yourself on the selling process as well. We look forward to hearing from you.

Selling a business takes planning, strategy and time, which comes with experience in the field. Unless you are selling your $1MM Cashflow business. Which is in the booming industry with upward trajectory for an asking price of $200,000. There is no way any business broker is going to be able to sell your business within 3 months. This scenario will likely not happen. As you the seller want to achieve the highest gains from the sale of your business. Why do some brokers claim they can sell my business in 3 months or less, probably because they want a retainer.

We have seen that on average it takes anywhere from 6 to 9 months to sell a business. Sometimes sooner sometime later than this timeframe. Let me highlight the factors involved. What type of business it is, how is the financial health of the business, are there systems in place for a new owner to take over, is there owner financing available, how motivated is the seller among various other factors.

The fastest we sold a business was 5 months from the time that we listed to the time it closed. There are various steps that are needed for us to take the business to market accurately. After that comes fielding and following up the buyers, then an LOI – which is letter of intent. Due diligence follows, contracts that are negotiated with both side of the attorneys, funding, and the closing. At GillAgency we adhere to strict standards. After the LOI has been accepted, we strictly enforce 30 days of due diligence, 15 days to go in contract and 15 days to schedule closing.

So, from experience this statement “brokers claim they can sell my business in 3 months” does not seem credible. Visit https://gillagency.co/our-process to read exactly how the process works and then ask yourself – how can all this be done in 3 months?

Ever wonder if there are seasonalities to small business mergers & acquisitions, so that you can list it at the prime time?

Please watch the YouTube video here – https://youtu.be/Qxe69C9Qt1w

Unlike Real Estate where majority of transactions go in hibernation in the winter time, there is no real seasonality to small business M&A. What does matter is how you dress the business and place it on the marketplace for a sale. We have seen over the past that private equity firms activity strengthens towards the end of the year as they may be sitting on “dry powder”. So 4th quarter is significantly important for them. 1stquarter does seem like that it slows a bit but then again, if the business is dressed and placed right in the marketplace then it doesn’t matter. 2nd and 3rd quarters are also very ripe as everyone is out and about and looking to sell or buy businesses, longer days contributes to this activity.

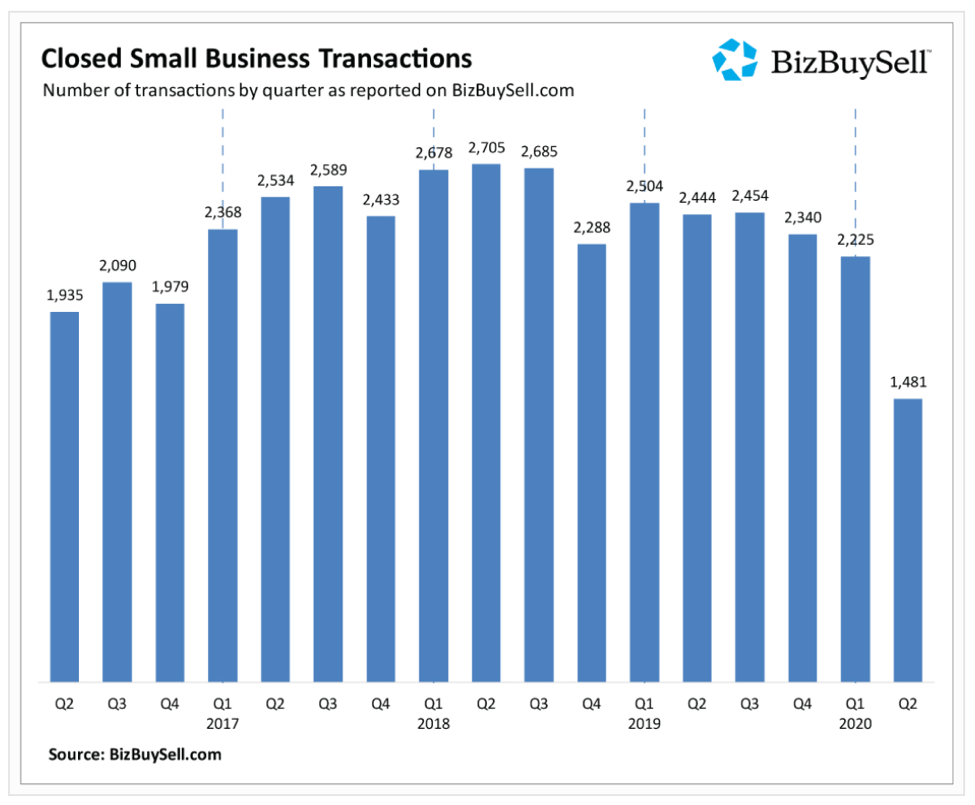

As per bizbuysell a leading website for small business M&A, the small business transactions in Q1 of 2019 were 2,504, Q2 was 2,444, Q3 was 2,454, Q4 was 2,340.

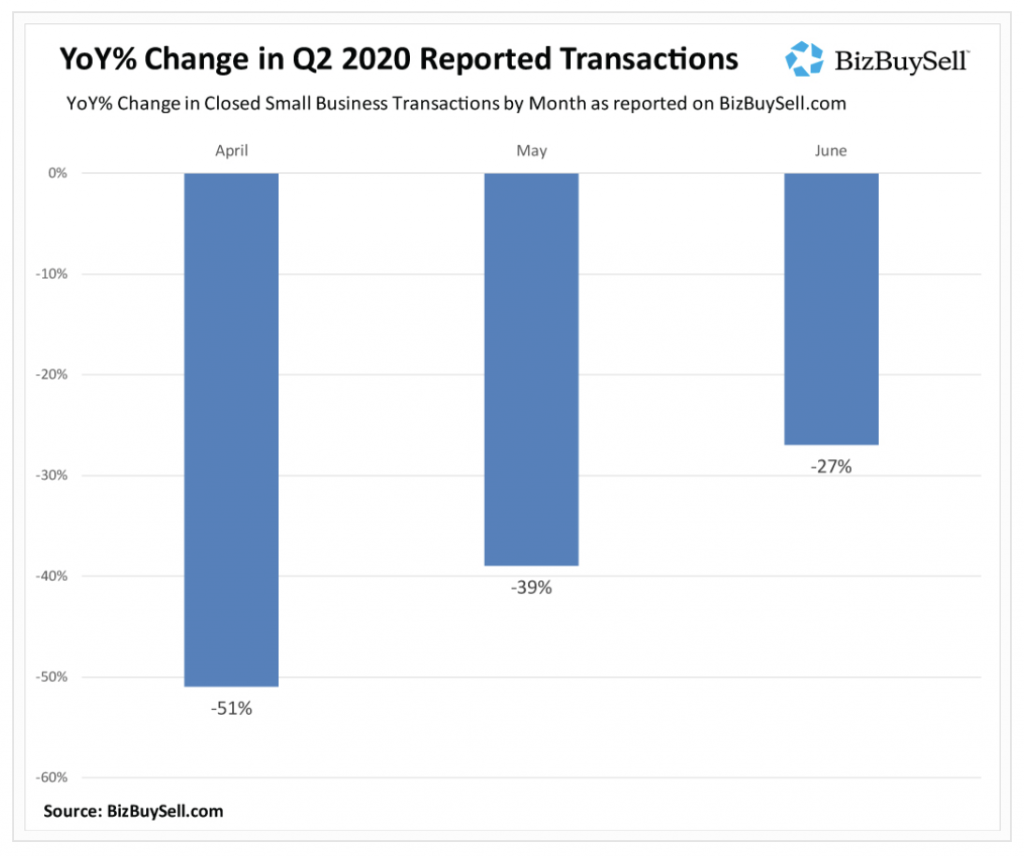

So you can see there isn’t a real seasonality to small business mergers & acquisitions. I’m not going to go into 2020 because in my opinion this year would be an anomaly.

But you can tell by looking at the activity that the small business M&A activity is bouncing back and fast. I expect this trend to keep on growing as everyone is getting use to this new normal amidst COVID19.

Again, to emphasize, you have to have what it takes to sell your business and the time of the year does not matter, head on over to https://gillagency.co/how-to-sell-my-business-a-step-by-step-guide to read a step by step process in how to sell your business.

At some point, you as a business owner will explore the possibility of selling your business for variety of reasons. It can retirement, health reasons, fatigue, or pursue other goals. Exit planning is the complete strategy for selling a company.

Please watch the YouTube video here – https://youtu.be/5bkRHW3lKiE

It involves several factors, like what are your personal goals, what are the goals for the company the financials of the company, legal, tax, and how to safely exit while maximizing your enterprise value.

Now this exit planning should not take place when you are ready to sell. This planning needs to take place way before that. This will allow the business owner peace of mind that everything is already taken care of. 75% of the business owners do not have any exit plan in place, which is eye opening when you consider that 80% of the business owners have their net worth tied to their business.

In a nutshell, you as a business owner should start today and I mean right now to start this exit planning. To achieve the highest enterprise value, you should start to focus on the financials of the business and make sure they are clean year over year, pay as much taxes as possible so that the business is financeable, invest in your employees and groom one or two individuals to run your company so that the company is not owner dependent, diversify your business by ways of clients/products/distribution channels to avoid concentration risk, solidify contracts in writing for at least 2 years on an auto renewal. This is obviously not the entire list of exit planning as each industry/business has their own exit planning requirements. Consult with us today to learn more.

Please visit https://gillagency.co/how-to-sell-my-business-a-step-by-step-guide which will provide you with a guideline on how to plan your exit planning,